Investments & Savings in Hungary 2022 – Can You? Should You? How-to? 📈

- Írta: Patrik Veres

- publikálva: 2022. August 04.

- frissítve: 2023. September 01.

- Olvasási idő: 6 minutes

Also, the simple fact that you can download a crypto exchange app and can get involved with a “special de-fi savings product” does not mean that you should. There are a lot of ways to invest & earn money, from gold and cryptocurrencies, to stocks, bonds & ETFs. So, if you have the means and the will to invest money – we can also help with the how-to. This way you can make your funds work for you the exact way you want them to!

Should I even invest? Isn’t my money safer under a rug?💸

Of course, there is never a 100% guarantee on any kind of investment. We can gain a lot of insight from historical charts & data, but they are far from a full-proof source of information. Based on this, it can be said that there are very safe ways to store your money, but there always will be drawbacks:

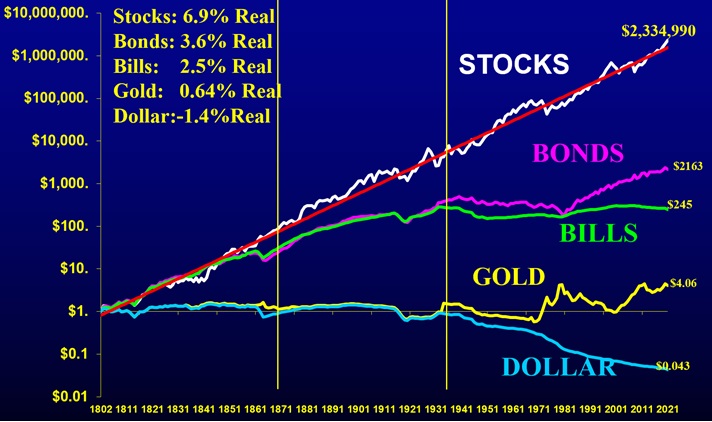

Total Real Return Indexes ( January 1802 – December 2021)💱

Source: Jeremy Siegel: Stocks for the Long Run (2014), data updated to 2021; https://www.etftrends.com/

Pouring your cash into physical gold might look like a good idea at first sight, but if you look at the historical chart, that is simply not true. There are much more profitable ways to invest your money, but it is also clear that gold is most useful in a portfolio to hedge against inflation.

Stocks can bring high returns, but as the dot-com bubble showcased perfectly: their value can evaporate within a few days – an issue that does not exist when talking about long-term gold investments.

Your mixture of assets should reflect your willingness to endure risks. This is the exact reason it is almost impossible to make a portfolio that works for everyone – and the reason we strongly recommend a personal consultation to each and every one of our clients before making a decision.

💹 What to invest in in 2022? 🧮

There are a ton of ways to invest in Hungary today. At GRANTIS we can help you with most of them, so we compiled a short list of assets that a lot of our clients need assistance with.

There are two basic types of investments: short-term and long-term. Differentiating between them is easy: if you hold an asset for over a year then we are talking about long-term investing, everything under that is short-term.

It is also important to know that one type of asset can be used both ways. If you have a Unit Linked Insurance Plan that contains stocks for a company, and you plan to hold the policy, then the stock is used as a long-term asset. But in the hands of a day-trader, the very same stock can be a short-term investment, as he will probably try to get rid of it during a short holding period.

Short-term investments in Hungary

A few basics: if you are planning to invest for a shorter period of time, you will most likely choose a volatile asset. The price of the commodity you bought should move quickly, as it is the only way to make money with this kind of time constraint.

Also, these kinds of assets should be highly liquid, as you will need to buy and sell as fast as possible when the price is right. Most common short-term investments are stocks, while some are bonds, ETFs, and cryptocurrencies.

We would strongly advise against risky and extremely volatile markets, as, for example, the current crypto-market. If you do not know exactly what you are doing, it is simply too risky! Investing money without proper expertise or professional help can go belly-up real fast.

If you are looking for short-term investment opportunities in Hungary, do not hesitate to call us! By giving us more information on your specific needs & opportunities, we can create a realistic investment plan for you and your family.

Long-term Investments in Hungary

In a long-term investment portfolio, it is possible to include a few riskier assets. Because of the longer time period, it is much easier to mitigate the dangers of investing in one or more “wild cards” in your mixture.

Because you are planning to keep these financial instruments for a longer period of time, there are different aspects that you need to keep an eye out for. Instead of daily or monthly price ranges, you will look for long-term price movements. Instead of liquidity, you will look for predictability.

Real Estate, state bonds, stocks, and ETFs all can be considered perfect long-term assets to invest in. As always, the proper course of action depends on your very specific situation. If you have a lot of money to invest, but you want to keep it liquid, ETFs might be your best bet. But if you are comfortable with a less liquid form of value, then you can’t really go wrong with real estate. Mixing the two might be even better!

If you are planning to stay for a longer time, or your state of origin allows you to move in insurance policies from abroad, then a Unit-Linked Insurance Plan (or ULIP) might be the best choice for you. With this kind of policy, you will be able to link a health insurance or a pension fund with an investment portfolio. It is also possible to gain a significant amount of tax returns (ranging up to 280.000 HUF) from the Hungarian Government if you choose to go down this path. We are able to set you up with such policies, and it comes highly recommended by thousands of our domestic and international clients.

We Can Help! Savings, Investment & Credit Consultation by GRANTIS

This article touched only on the very basics of investing. It is simply impossible – and would be highly misleading – to give a complete and definitive assessment of the Hungarian financial environment in such a short summary. It can also be said that a well-thought-out portfolio should have both long and short-term investment plans in order to ensure that our client stands on firm economic grounds throughout the years.

We are doing a series of articles for the foreigner and expat community in Hungary to help you navigate our credit, insurance & investment market. We understand that it might be hard to operate and settle in a brand new country, so we would like to do anything in our power to make it easier for you. In the meantime, if you have any questions, or if you need assistance in the fields mentioned above, contact us! The consultation with our experts and advisors is completely free of charge, and you can gain valuable insight into these financial markets through the lenses of professionals.

Ebben a cikkben

Tartalomjegyzék

Apply for a free consultation with one of our English-speaking financial advisors!

By giving your information and some basic background about your situation and financial goals we can start our initial research for an ideal solution for you. We are here to help!

Apply for a free consultation with one of our English-speaking financial advisors!

By giving your information and some basic background about your situation and financial goals we can start our initial research for an ideal solution for you. We are here to help!